Financial Information

Financials

Quarterly Report For The Financial Period Ended 31 December 2024

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

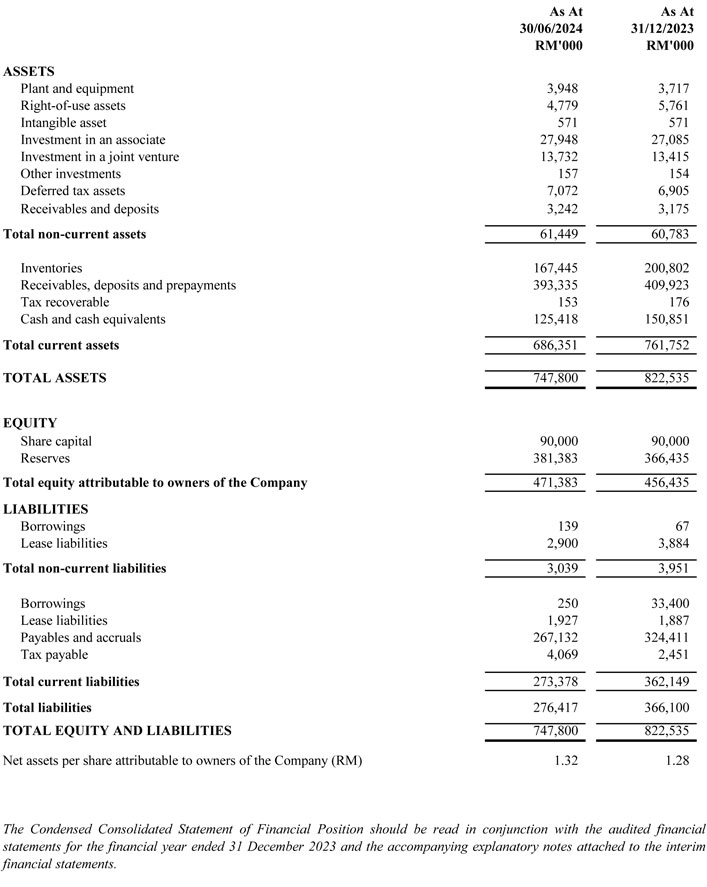

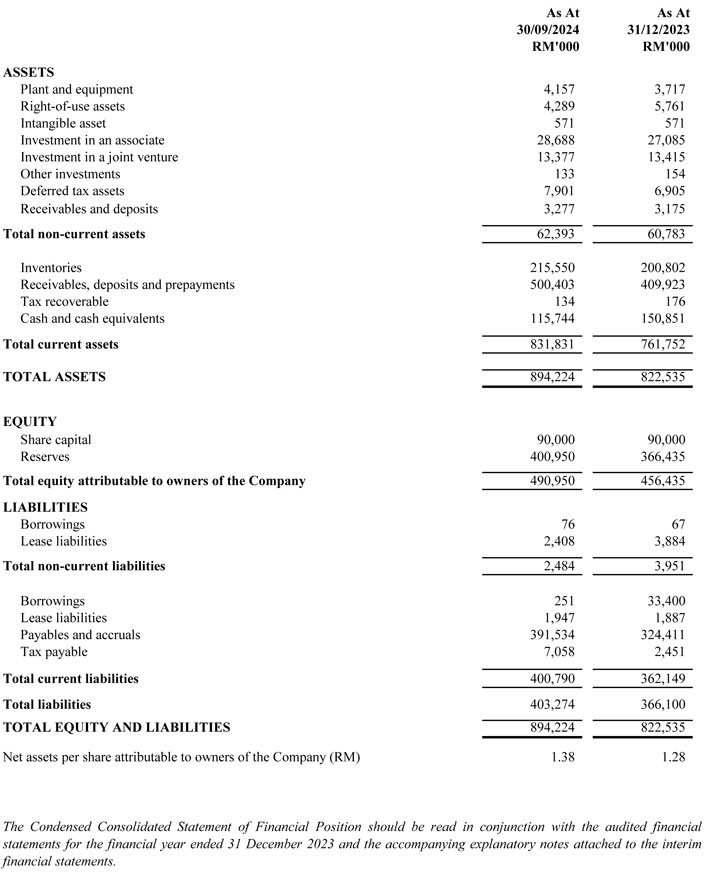

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION AS AT 31 DECEMBER 2024

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE QUARTER AND YEAR ENDED 31 DECEMBER 2024

Review of performance

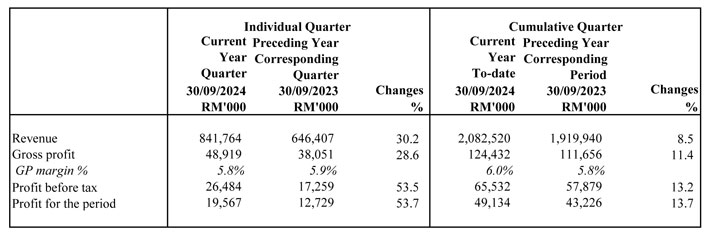

Q4 FY2024 compared with Q4 FY2023

For Q4 FY2024, the revenue increased by 1.5% to RM819.2 million from RM807.2 million last year attributed to higher sales from ICT Distribution. Gross profit (GP) increased by 13.5% to RM47.9 million from RM42.2 million last year.

Profit before tax (PBT) increased by 10.8% to RM27.6 million from RM24.9 million after accounting for higher foreign exchange and fair value gains by RM5.5 million but was mitigated by increased operating expenses by 36.5% and impairment of financial instrument by RM1.9 million.

Quarterly Segmental Result

The performance of the three business segments for Q4 FY2024 compared with Q4 FY2023 were as follows:

-

ICT Distribution

Revenue increased by 6.7% mainly from notebook and gaming devices. With higher sales, PBT increased by 2.7% to RM7.2 million compared with RM7.0 million last year.

-

Enterprise Systems

Revenue decreased by 5.9% due to lower sales of commercial notebook, PC, workstation and storage. However, with higher GP margin from product mix, PBT increased by 11.8% to RM52.6 million as compared to RM47.1 million last year.

-

ICT Services

Revenue increased by RM56.2 million, driven primarily by stronger sales in cloud services and maintenance services. With higher sales and GP, PBT increased by 48.9% to RM13.4 million as compared to RM9.0 million last year.

Prospects

Fueled by strong foreign investments and government-driven initiatives, Malaysia's GDP grew by 5% in the fourth quarter of 2024 and 5.1% for the whole of last year. However, potential challenges include the introduction of new taxes, geopolitical tensions, and increasing economic competition, particularly in the global technology sector.

Despite these uncertainties, the consumer sector is expected to thrive, supported by improved disposable income and positive sentiment. The replacement cycle for AI-enabled devices is anticipated to move in earnest as consumers upgrade their postpandemic devices.

The AI landscape is also undergoing a significant shift with DeepSeek's open-source models, which democratize AI access beyond major providers. This change enables businesses and individuals to train and deploy their AI models on-premise, increasing demand for cost-effective GPU servers and positioning VSTECS as a key enabler in Malaysia's AI ecosystem.

Meanwhile, the public sector is set for a resurgence, with major ICT projects already being awarded since November 2024 to counter the slowdown experienced throughout last year.

With strong prospects in the consumer, enterprise and public sectors, we are optimistic on Q1 and the overall trajectory of FY2025.